A practical CFO playbook using Rise’s hybrid fiat + crypto infrastructure

Global payroll has become harder, not easier: multiple currencies, slow banking rails, international contractor payments, compliance requirements across 190+ countries, and the constant pressure to move faster while controlling risk.

But one thing CFOs keep running into is this: your banking stack isn’t built for fast global payouts.

That’s where USDC comes in.

With Rise, CFOs can fund payroll in USDC without replacing banks, moving treasury structures, or rebuilding approval workflows. Rise’s platform is designed to let finance teams keep everything exactly as it is today, while simply adding USDC as a flexible, instant, global payment rail.

Here’s the exact process.

1. Keep your existing banking setup exactly as-is

Rise does not require:

- new bank accounts

- new treasury infrastructure

- new entities

- new crypto-native HR systems

- wallet-to-wallet transfers

- spreadsheets

Rise is already built to work with traditional bank treasuries or crypto wallets, including USDC.

You simply choose your funding source during the payroll flow.

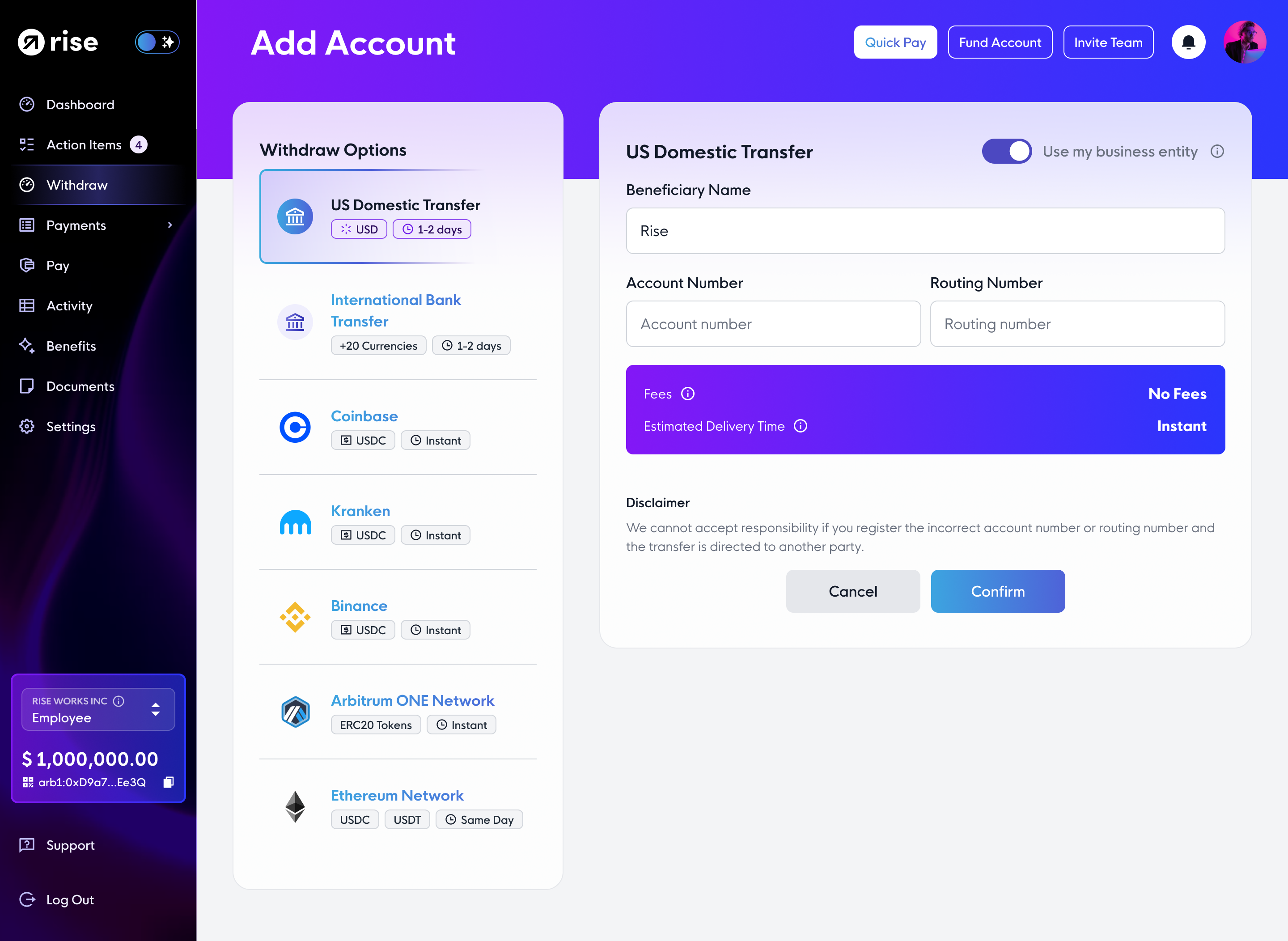

Choose your funding source the flexible way from either traditional or on-chain treasuries.

This is what makes USDC payroll plug-and-play for CFOs, you add a second funding rail, not a second banking system.

2. Deposit USDC directly from your existing crypto wallet

.png)

Rise supports funding payroll in USDC or USDT with the same workflow as USD funding.

Fund payroll in either US dollars or USDC/USDT stablecoin.

This means even if your treasury is primarily fiat, you can fund some or all payroll in USDC using any existing on-chain wallet.

There is no need for a specific exchange or partner bank integration.

Funding in USDC = no changes to banking, treasury logic, or controls.

3. Rise handles all routing between fiat and crypto on the backend

Once USDC is deposited, Rise automatically handles all conversions so your contractors or employees can withdraw in their preferred currency.

We automate the routing between fiat and crypto.

This is important for CFOs:

- You fund in USDC

- Rise automatically delivers each worker’s preferred currency

- No additional systems, exchanges, swaps, or reconciliation workflows needed

Even if your team withdraws in:

- local currency

- USDC

- USDT

- another cryptocurrency

Rise takes care of the conversion flows.

4. Set up payment schedules with zero operational changes

Once funded, Rise allows you to run payroll using the same workflows you’d use for fiat.

Choose from many options (daily, weekly, bi-weekly, monthly, one-time, recurring, project based).

CFOs can activate USDC-funded payroll without altering:

- HRIS

- accounting systems

- treasury approval workflows

- contractor onboarding

- agreements

- tax documentation

Everything runs inside Rise’s unified platform.

5. Workers withdraw in their preferred currency with no extra work for finance

After payroll is funded in USDC, employees or contractors choose how they want to withdraw:

Employees can withdraw their earnings in their local currency or cryptocurrency.

Contractors choose to receive their earnings in either fiat or crypto.

This means that even if you fund payroll entirely in USDC:

- one worker can take local currency

- another can take USDC

- another can take another crypto asset

- another can split their withdrawal

Finance does not have to manage anything manually.

6. Maintain full compliance in 190+ countries

Adding USDC does not increase compliance load. Rise automatically handles:

- onboarding

- identity verification

- KYC

- AML

- tax forms

- compliant agreements

- local regulations

Identity verification, KYC and AML, and professional agreements all in minutes.

Navigate international tax laws and regulations confidently, maintaining compliance at a local level for every contractor.

This is why CFOs can safely add USDC without expanding internal legal or finance burden.

7. Preserve auditability, controls & security

Rise provides:

- SOC 2-level security

- encrypted data

- access controls

- fully compliant money transmitter infrastructure

This means adding USDC does not weaken internal controls or increase risk.

8. Pay globally in seconds instead of days

Once you fund payroll in USDC, payouts are instant.

This replaces slow, expensive global wire transfers without altering your banking infrastructure.

Final Summary for CFOs

Rise allows CFOs to fund global payroll in USDC without changing any part of their existing banking stack.

You can:

- Keep your banks

- Keep your treasury tools

- Keep your approval workflows

- Keep your accounting systems

And still unlock:

- instant global payouts

- automatic fiat/crypto routing

- compliance in 190+ countries

- contractor onboarding

- tax forms

- daily payroll

- flexible worker withdrawals

- reduced operational overhead

All using a single, compliant, SOC 2-certified platform.