We just launched our new brand. Check it out and see how we are changing the Remote Payment HR world forever.

What is a 1099 Employee?

A 1099 employee, also known as an independent contractor, is a person who performs work for a business or organization but is not considered an employee for tax purposes.

Independent contractors are responsible for paying their own taxes and are not eligible for the same benefits as employees, such as unemployment insurance or workers' compensation.

Independent contractors are typically paid on a project-by-project basis and are not eligible for employment benefits such as health insurance or retirement plans.

They are also not entitled to the same protections as employees under labor laws, such as minimum wage and overtime pay.

Businesses and organizations may choose to use independent contractors instead of employees for a variety of reasons, including the potential for cost savings and greater flexibility in managing their workforce.

However, there are strict rules for determining who can be classified as an independent contractor, and misclassifying employees as independent contractors can have serious consequences for businesses.

In the United States, independent contractors are required to report their income on Form 1099-MISC, which is why they are often referred to as 1099 employees.

1099 Employee vs. Gig Worker vs. Freelancer

The terms 1099 employee, gig worker, and freelancer are often used interchangeably, but there are subtle differences between them. Understanding these distinctions can help workers and businesses alike better navigate their roles and responsibilities.

A 1099 employee is a broad term for anyone working as an independent contractor, whether they are performing freelance work, gig tasks, or running a small business.

Gig workers, on the other hand, tend to work on-demand through platforms like Uber, Lyft, or TaskRabbit.

They usually have less control over how they perform their work since the platform dictates many aspects of their job, from payment rates to customer interactions.

Freelancers are generally more specialized and independent than gig workers. Freelancers typically work in creative industries like writing, graphic design, or web development, where they have greater control over project scope, pricing, and client relationships.

They may work with multiple clients simultaneously and can choose their own work hours and projects.

Despite these distinctions, all three types of workers are considered 1099 employees for tax purposes and are responsible for handling their own business expenses, taxes, and benefits.

Differences between 1099 Employees and W-2 Employees

Understanding the distinction between 1099 employees and W-2 employees is crucial for both workers and employers.

A 1099 employee, often referred to as an independent contractor, operates as a self-employed individual.

They are responsible for managing their own taxes, benefits, and business expenses.

In contrast, W-2 employees are considered traditional employees who receive a regular paycheck with taxes automatically deducted by their employer.

W-2 employees typically receive benefits such as health insurance, retirement plans, and paid time off, which are not provided to 1099 employees.

Common Industries for 1099 Employees

1099 employees can be found across a variety of industries. Common sectors include:

- Freelance Writing and Editing: Many writers and editors work on a contract basis, providing content for various publications and websites.

- Information Technology: IT professionals, such as software developers and network engineers, often work as independent contractors.

- Healthcare: Some healthcare professionals, including therapists and consultants, operate as 1099 employees.

- Construction: Contractors, electricians, and plumbers frequently work independently.

- Creative Arts: Graphic designers, photographers, and musicians often take on freelance projects.

1099 Employees in a Global Context

The concept of independent contracting is not limited to the U.S.

As the global economy evolves, more professionals are taking advantage of remote work opportunities, allowing them to serve clients internationally as 1099 employees.

In many countries, the legal framework surrounding independent contractors is similar to that of the U.S., but nuances exist.

For example, the United Kingdom allows for independent contractors but has strict guidelines to ensure workers are not misclassified.

In the European Union, laws vary from country to country, with stricter labor protections in places like Germany and France.

When working internationally, 1099 employees need to be aware of cross-border tax implications.

Some countries have tax treaties with the U.S., which may reduce the burden of paying taxes in both jurisdictions.

Additionally, fluctuating exchange rates and currency conversion fees can impact the earnings of global contractors.

For U.S.-based companies hiring international 1099 employees, it's crucial to understand the legal and tax requirements in the contractor's home country.

Employers may need to provide certain documentation or comply with local regulations to avoid penalties.

Benefits of Hiring a 1099 Employee

Hiring 1099 employees offers numerous advantages:

- Flexibility: 1099 employees have the freedom to choose their projects and set their own schedules, allowing for adaptable work arrangements.

- Control: Independent contractors manage their own business operations and client relationships, reducing the need for employer oversight.

- Cost Efficiency: Without the obligation to provide a fixed salary, employers can engage 1099 employees on a project basis, potentially reducing overall labor costs.

- Tax Benefits: Employers are not responsible for withholding taxes or providing benefits, as 1099 employees handle their own business-related expenses and deductions.

Disadvantages of Being a 1099 Employee

Despite the benefits, there are also challenges associated with being a 1099 employee:

- Lack of Benefits: You won't receive health insurance, retirement plans, or paid time off from an employer.

- Tax Responsibilities: You must manage and pay your own taxes, including self-employment tax.

- Income Instability: Your income may fluctuate based on the availability of projects and clients.

- Administrative Burden: You are responsible for all aspects of your business, including invoicing, record-keeping, and marketing.

The Future of the 1099 Employee Model

The 1099 employee model is continuing to grow, driven by technological advancements and shifting labor market dynamics.

With the rise of remote work and freelancing platforms, many predict that the independent contractor model will become even more prevalent in the coming years.

As more workers embrace freelance and gig work, businesses are finding that 1099 employees can offer greater flexibility, scalability, and cost-effectiveness.

However, this shift is not without challenges.

Governments are increasingly scrutinizing the gig economy, with many debating whether gig workers should receive the same protections as traditional employees.

Legislation like California’s Assembly Bill 5 (AB5) has already reshaped the landscape for 1099 employees by tightening the rules around worker classification.

Looking ahead, further regulations may emerge at both state and federal levels to ensure the fair treatment of 1099 workers, potentially offering new benefits or protections.

Additionally, as automation and artificial intelligence advance, the nature of freelance work itself may evolve, with new opportunities arising in tech-driven industries.

How to Become a 1099 Employee

Transitioning to a 1099 employee involves several steps:

- Identify Your Skills: Determine what services you can offer as an independent contractor.

- Set Up Your Business: Register your business, obtain necessary licenses, and set up a business bank account.

- Create a Portfolio: Showcase your work and skills to attract potential clients.

- Market Yourself: Use social media, networking events, and online platforms to promote your services.

- Find Clients: Reach out to potential clients and apply for freelance opportunities.

Tax Implications for 1099 Employees

As an employer working with 1099 employees, it's important to understand their tax responsibilities. This includes:

- Self-Employment Tax: 1099 employees must pay both the employer and employee portions of Social Security and Medicare taxes.

- Quarterly Estimated Taxes: To avoid penalties, 1099 employees need to make estimated tax payments throughout the year.

- Deductions: 1099 employees should keep track of their business expenses, as these can be deducted from their taxable income.

Record-Keeping Tips for 1099 Employees

Effective record-keeping is essential for 1099 employees:

- Track Income and Expenses: Maintain detailed records of all business transactions.

- Save Receipts: Keep receipts for any business-related purchases.

- Use Accounting Software: Simplify your record-keeping with accounting software designed for small businesses.

- Organize Documents: Store important documents, such as contracts and tax forms, in an organized manner.

Legal Considerations for 1099 Employees

Navigating the legal landscape is vital for 1099 employees:

- Contracts: Always use written contracts to outline the scope of work, payment terms, and deadlines.

- Business Structure: Consider forming an LLC or corporation to protect your personal assets.

- Insurance: Obtain liability insurance to safeguard against potential legal claims.

- Compliance: Ensure you comply with local, state, and federal regulations.

Finding Work as a 1099 Employee

Securing work as a 1099 employee requires proactive efforts:

- Networking: Attend industry events and join professional organizations to connect with potential clients.

- Online Platforms: Utilize websites like LinkedIn, Upwork, Fiverr, and Freelancer to find job opportunities.

- Referrals: Ask satisfied clients for referrals and testimonials to build your reputation.

- Cold Outreach: Reach out to businesses and individuals who may need your services.

Negotiating Contracts and Rates

Effective negotiation skills are essential for 1099 employees:

- Research: Understand industry standards and typical rates for your services.

- Value Proposition: Clearly articulate the value you bring to clients.

- Flexibility: Be open to negotiating terms that benefit both parties.

- Written Agreements: Ensure all terms are documented in a written contract.

Building a Professional Network

A strong professional network can enhance your career as a 1099 employee:

- Join Associations: Become a member of industry-specific associations and groups.

- Attend Events: Participate in conferences, workshops, and seminars to meet peers and potential clients.

- Online Presence: Maintain an active presence on LinkedIn and other professional networking sites.

- Collaborate: Partner with other freelancers and businesses to expand your opportunities.

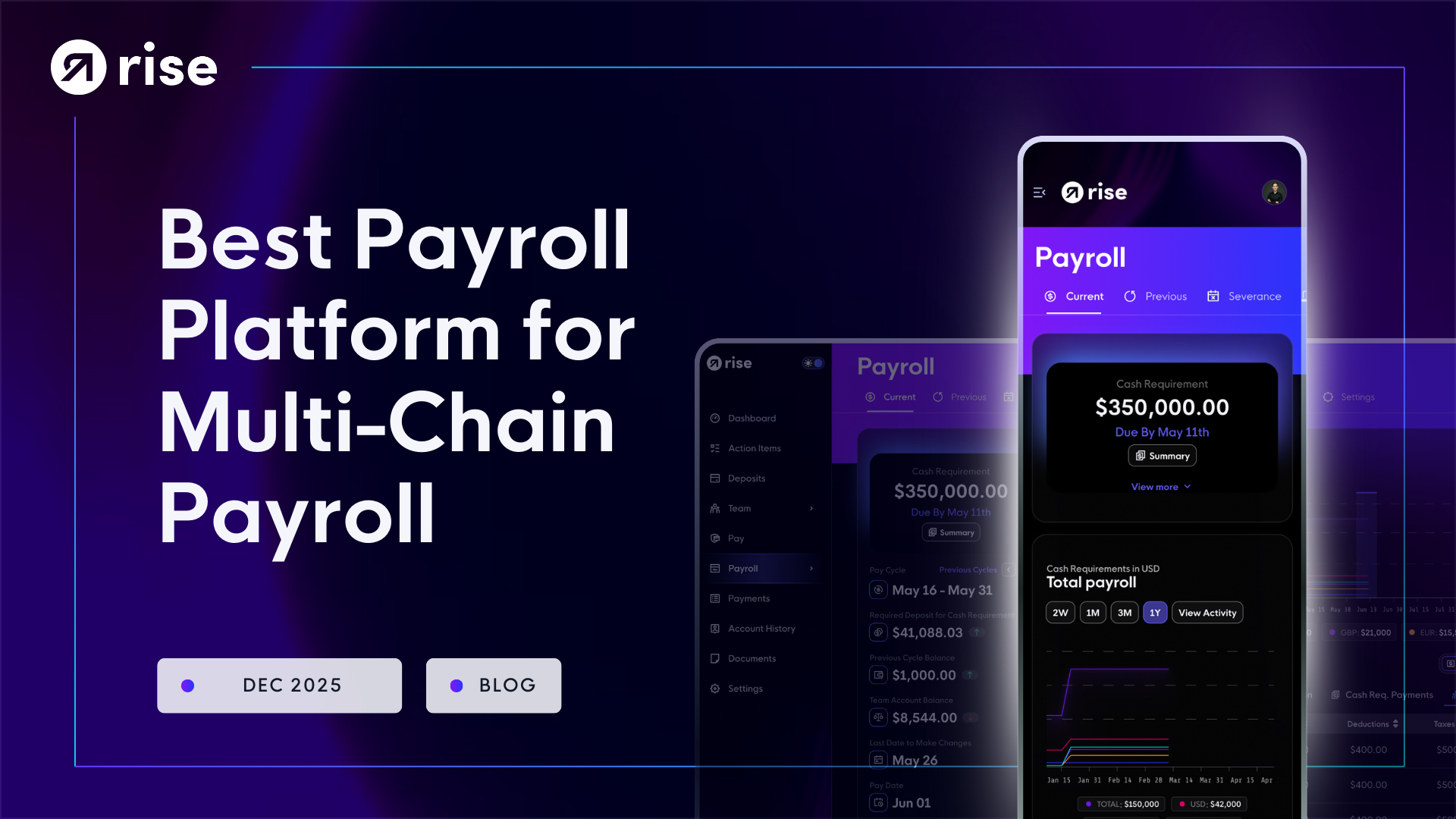

Revolutionize your Payroll & Empower your People

Get access to the definitive guide on web3-enabled payroll and compliance solutions